Fraud is one of the biggest challenges that the telecommunications industry faces. As our dependence on telecommunications technologies rises, so is the occurrence and frequency of fraud. New technologies lead to fraudsters finding new ways of manipulating network and operational vulnerabilities to make a profit. The onus of finding ways to curb fraud lies on the telecom companies.

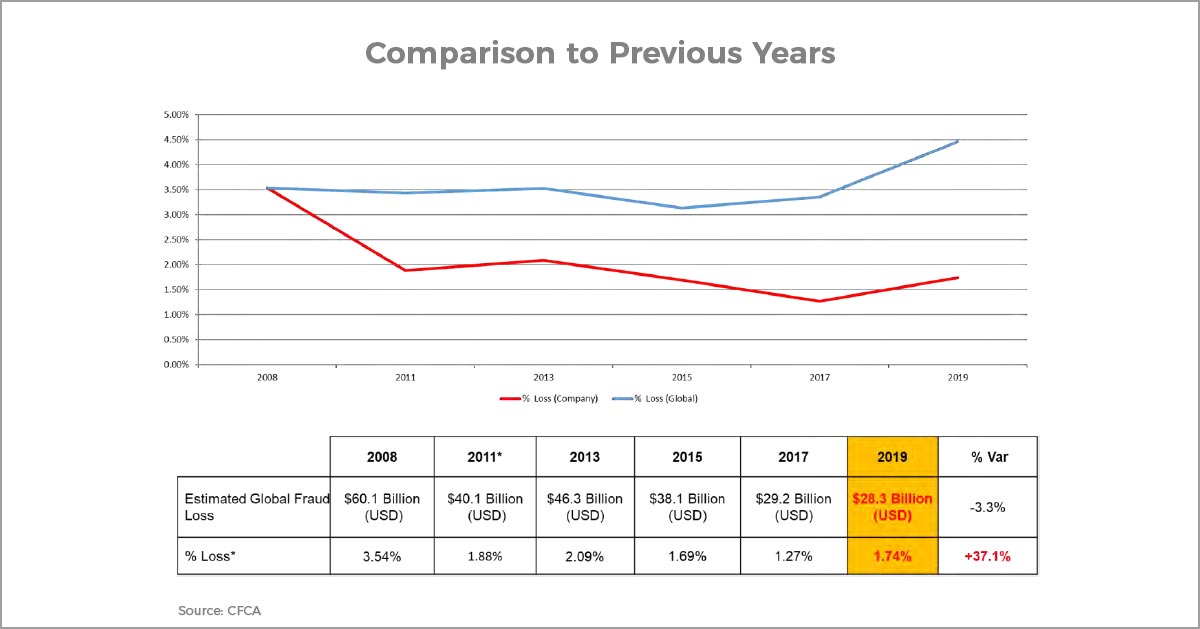

A global telecom fraud survey conducted by the Communications Fraud Control Association (CFCA) offers interesting insights about telecom fraud. Fraud losses in 2019 amounted to $28.3 billion or 1.74% of the total revenues, recording a growth of 37% compared to 2017. The top 5 fraud methods reported by carriers are subscription fraud, payment fraud, PBX hacking, IP PBX hacking and Wangiri fraud. The survey also lists the top 5 fraud types as International Revenue Share Fraud, Arbitrage, Interconnect Bypass (e.g. SIM Box), Domestic Premium Rate Service and Traffic Pumping. CFCA reports the top 5 emerging fraud methods as Payment Fraud, IP PBX Fraud, Abuse of network device, or configuration weaknesses, and IoT Fraud.

Changing Outlook of Carriers

The telecom industry’s outlook of fraud has evolved over the past few years. As per the 2019 ITW Global Leaders’ Forum (GLF) Fraud Survey, about 80% of the carriers consider fraud a strategic or top priority. About 56% of carriers said that the importance of fraud is increasing for their respective companies. The report also says that the carriers have reported an upward trend in the process of combating fraud. Operators have now joined carriers in dealing with fraud, as wholesalers are also increasing their involvement in the process. Carriers are of the view that combating fraud has become as important as the cost or quality of their services.

Successful fraud management has become synonymous with better service quality, considering that its financial benefit has been recognized by carriers. Customers prefer to pay a premium amount to avoid high-risk routes that are more prone to fraud. It is safe to say that for carriers, putting a greater effort in combating fraud can have a positive effect on their brand and reputation. Focusing on offering low-risk termination products and services are also more financially viable options for telecom companies in this increasingly competitive market.

Fraud Types on the Rise

Effectiveness of various types of fraud changes with time. Carriers focusing on eliminating a certain type of fraud may end up with fraudsters trying their hands at some other type. As the carriers put in more efforts in detecting and mitigating frauds, the sophistication level of fraudsters and the technologies being used to execute fraudulent activities by the perpetrators are also evolving. While carriers worked on refining their fraud management techniques and implementing cutting-edge fraud management systems, fraudsters shifted their attention to frauds like Wangiri and robocalling, says the 2019 GLF Fraud Survey.

A considerable reduction has been reported by carriers in the occurrences of Call Hijacking and False Answer Supervision, however, International Revenue Share Fraud (IRSF), Wangiri and PBX hack were found to be on the rise. IRSF involves using illegal resources to access an operator’s network and diverting traffic to International Premium Rate Numbers.

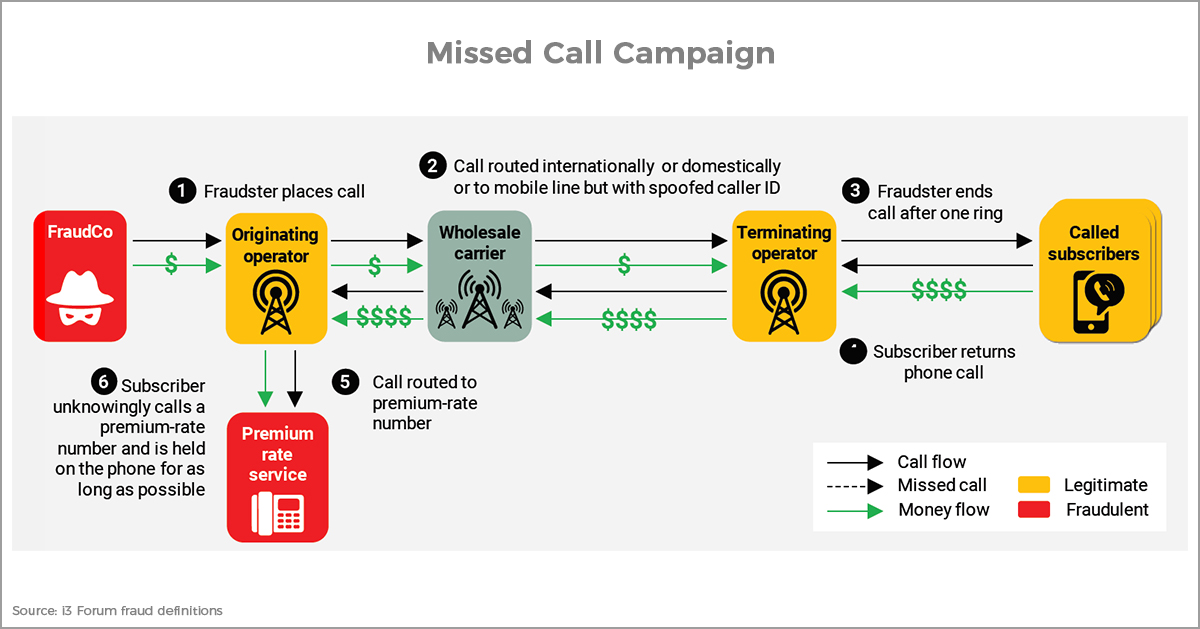

Overview of a Wangiri/Missed Call Campaign

Wangiri may have lost the top spot in the recent survey, but it continues to be a huge concern for the telecom players as it is challenging to identify and block. Use of a legitimate service like robocalling to broadcast fraudulent information is also considered a type of telecom fraud. It is a new addition to the GLF report as it wasn’t a concern for the carriers back in 2018. Some of the other frauds that continue to cause revenue leakage for the operators include SIMBox and toll bypass fraud. These frauds are prevalent in certain regions and have a huge impact on the Regulators’ ability to collect revenues.

Fraud Management: A Pre-requisite for Telecom Sector

The awareness about fraudulent activities in the telecom industry is currently at an all-time high. The importance of fraud management recorded an increase in 58% of the organization in the last one year, according to the GLF survey. Carriers have also noted that fraud management is often linked to improved call quality, considering it reduces grey route, prevents CODEC translation errors and avoids low voice quality during calls. Not managing fraud can also put their long-term business relationships at risk, as customers associate it with poor quality of service.

Operators, on the other hand, are most impacted by subscription fraud, payment fraud, roaming fraud and PBX hacking. This not only has a direct bearing on their bottom line, but also leads to a bad customer experience and subscriber churn. This is the reason operators prefer to always bundle a reliable revenue assurance system with their enterprise telecom fraud management solution (i.e. RAFM).

Fraud management systems have proved to have far-reaching effects, making the fraud-fighting culture a pre-requisite for the telecom industry. Carriers now perceive fraud management system to be necessary to mitigate fraud and are increasingly opting for tools based on advanced technologies like artificial intelligence (AI), machine learning (ML), automation, big data or blockchain. These telecom fraud management tools facilitate real-time behavioral modelling, with predictive risk assessment and test calling to avoid false positive scenarios.

Read Also

Telecom Frauds Under a New Garb: How They Look Like Now?

Is Fraud in Interconnect Business Eating into your Profits?

Conquer Financial Frauds with Thriving Technologies

Ideal Fraud Management System

With all of the above facts in mind, what would constitute an ideal fraud management system?

A typical fraud management system features a rules-based event processing application. This should further be augmented using an AI/ML engine that makes use of algorithms to also predict suspicious patterns and fraudulent behaviors along with detecting the anomalies. As for the blockchain based solutions, it is necessary to ensure complete transparency with the distributed ledger technology and help resolve disputes faster amongst all the impacted carriers and operators. The most expedient solution is the one that addresses all the concerns of carriers as well as operators by covering both revenue assurance and fraud management as part of a single unified platform. It should be capable of analyzing individual events using a rules engine along with an AI/ML engine detecting threats and predicting fraudulent activities by looking at long term trends and anomalies.

Contributing Writer: Krati is a content creator at Panamax Inc and has over 6 years of experience in the digital domain. She holds a degree in Journalism and enjoys writing about everything tech.