Banks have already started to adapt with the technology advancements in the industry and the outbreak of COVID-19 has expedited their digital progress. Projects that traditionally required months or even years were completed in weeks to satisfy the demands of the new circumstances. Banks that have invested the last decade in digitalizing their operations have become more adaptable and resilient than others in responding to COVID-19-led transformations.

Customers seek personalized banking experience and accessible services anytime and anywhere. Therefore, more and more banks are turning towards the digital turf to have an edge over competition. The Banking industry is tapping on the variety of digital services such as eKYC, mobile banking, omni-channel banking, WhatsApp banking and so on.

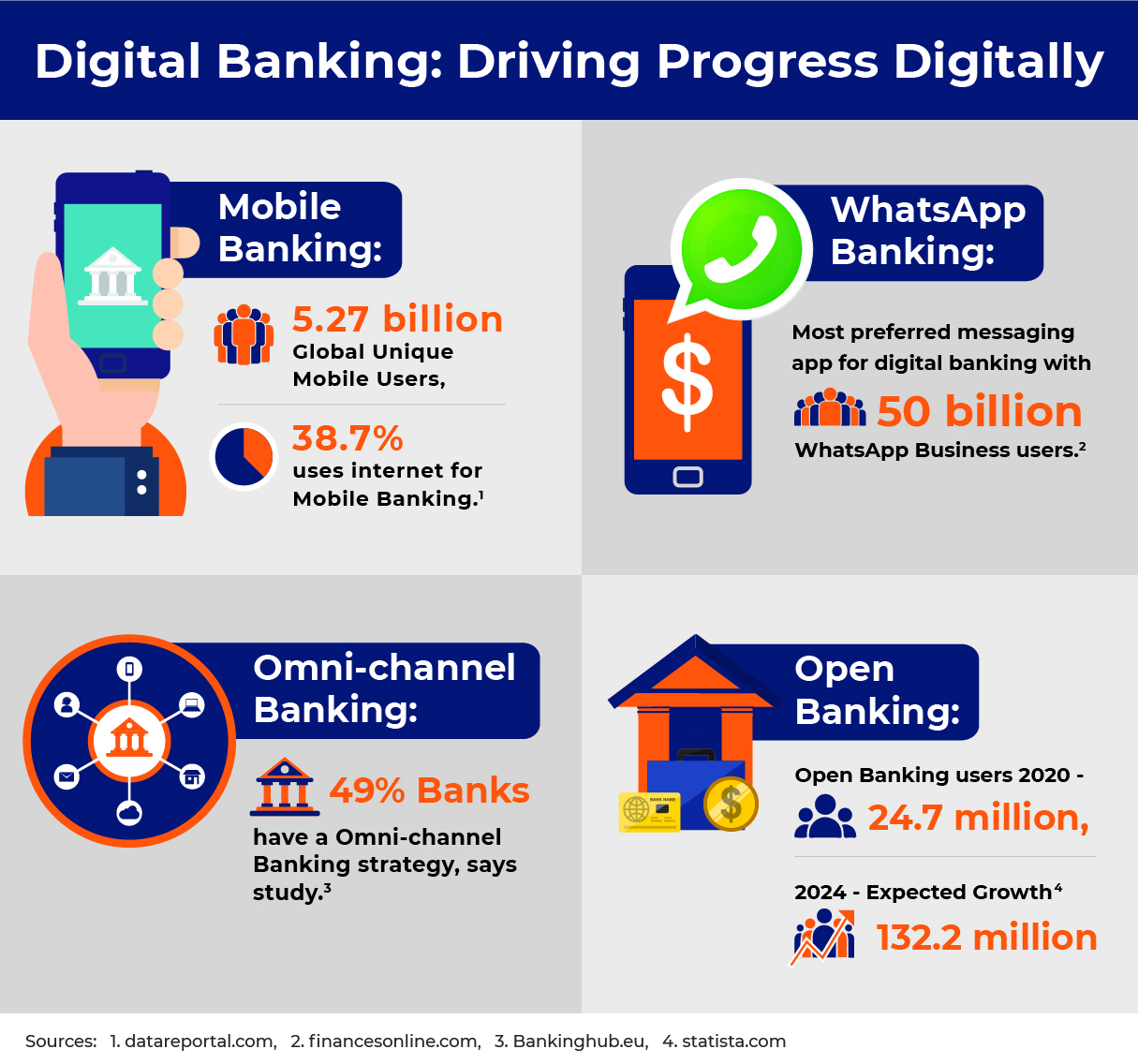

The infographic throws light on the future of digital banking and how the banking industry has transformed so far.

The Future:

The fintech market revolution is set to grow and traditional banks have to transform their conventional banking systems. Digital banking's future seems bright with fintech players influencing the market, resulting in increasing customer demand for easy digital access to banking services. These unparalleled innovation requires a new degree of agility and forward thinking and in this fast-paced digital ecosystem, banks have to act now with improved tech skills and digital services to meet increasing consumer expectations.

Related Blogs

Digital Banking: A Pre-requisite in the ‘New Normal’

Mobile Wallet: Changing the Dynamics of Digital Banking