The world is going through extraordinary times where both lives and livelihoods are at stake. COVID-19 has resulted in most industries being unsure about their future. Every strata of the society have been affected by the pandemic, but the most worrisome of all are the underprivileged. We have witnessed mass exodus, struggle for food and factories out of operations forcing several workers already living in marginal conditions to struggle for a living. What started with China has now affected most countries across the world and is strengthening hold over Africa and South Asia. The regions are already grappling with poverty, falling employment rates and looming economic crisis. The health scare only puts it in deeper problem.

Tracing the World Population

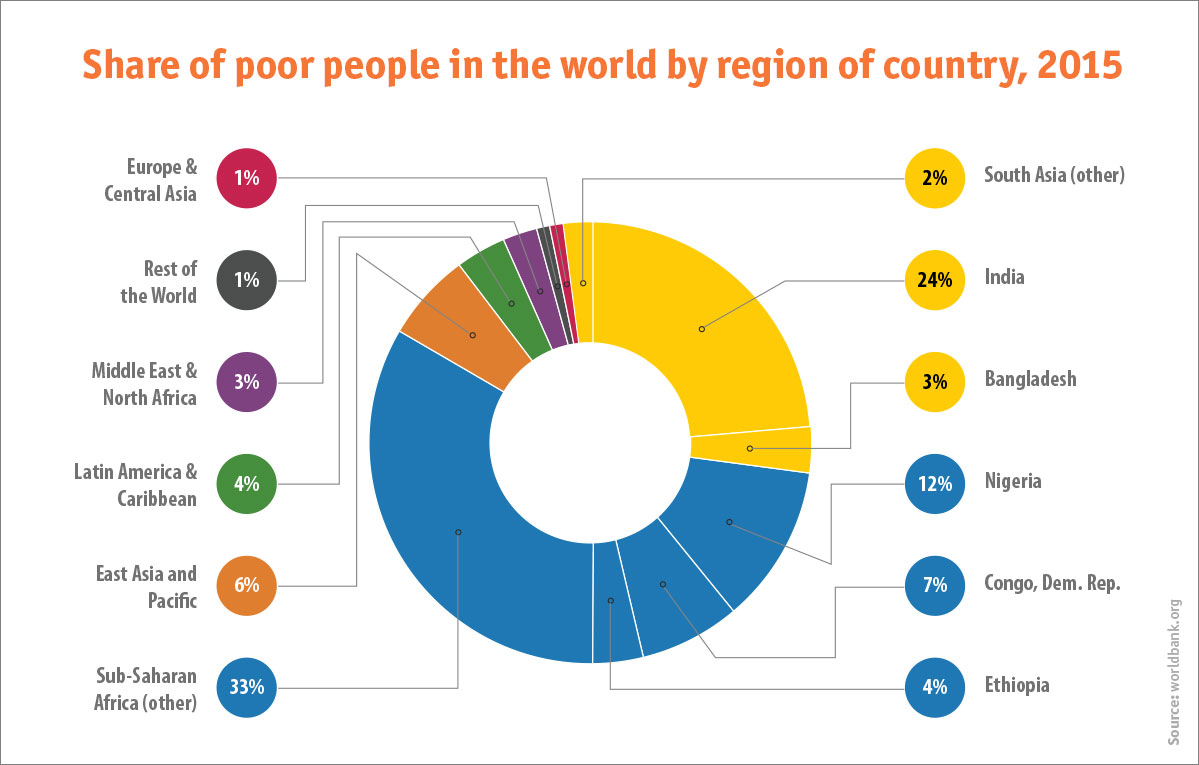

Analyzing the population chart shows that only 5 countries form almost half of the entire poverty spectrum. These are India, Nigeria, Democratic Republic of Congo, Ethiopia and Bangladesh. These countries account for 368 million extreme poor, half of the total 736 million extreme poor. Below is a chart depicting the poverty contribution on the basis of country and region across the globe.

The Pandemic vs The Poor

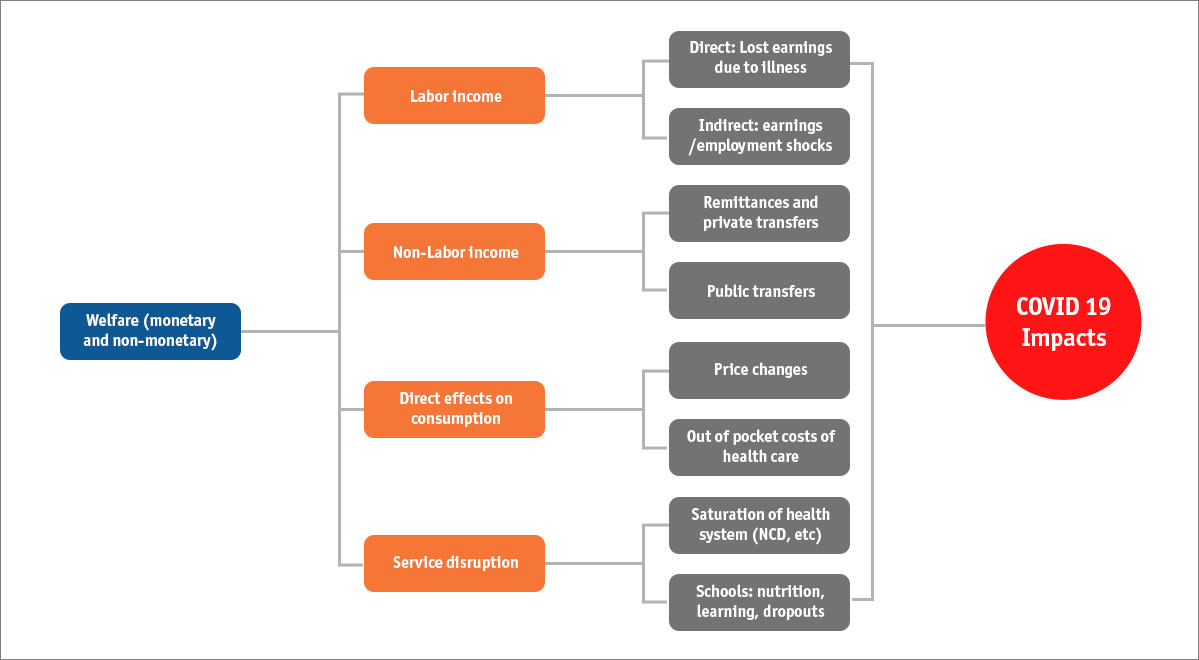

According to World Bank, 10 percent of the world’s population lived on less than $1.90 a day in 2015. This is down from nearly 36 percent in 1990. However, with the current health and economic crisis, there is a perpetual fear of the numbers getting worse. GDP projections for most countries have been revised to show a downfall particularly due to the demand and supply shock. The illustration below shows the impact pandemic will have on majority of the society.

The Role of Micro-Finance Institutes (MFIs)

MFIs have a big role to play when addressing this crisis due to their understanding of this population. According to MIX, MFIs serve 140 million low-income people worldwide with savings and credit services. As of 2018, the value of their credit portfolios was $124 billion. The customer base consists of 80 percent women, and 65 percent living in rural areas. Let’s understand the challenges MFIs face during this adversity and opportunities they can provide:

Problem Areas

- Liquidity stress – Almost all industries currently are struggling with capital due to loss of major business while people stay inside and lockdowns across several countries. This has caused a loss of an organic cash flow that maintained the equilibrium of any economy.

- Operational expenditure – Running a physical branch involves several overheads that only increase the overall cost of running a business. At a time when organizations offering micro lending solutions are struggling to bring in footfalls, these expenses pinch the pockets of the micro lending service providers.

- Credit risk of the borrowers - Since most borrowers to whom microcredit is given have little to no credit history due to their exclusion from traditional systems of credit, MFIs are unable to judge the risk associated with lending to certain borrowers, and cannot be sure what the risk of them defaulting will be.

- High repayment rates – Although this is a standard for the industry, high repayment rates are a turn off for the customers, especially during times when employments are uncertain.

Way Forward

- Financial Inclusion for marginal workers – The underprivileged are disregarded by the financial systems due to their inaccessibility and lack of a credit history. Micro loans, Remittances, Insurance products and knowledge on savings can help the marginalized enhance their contribution in the economy.

- Extending liquidity to MFIs – in turn increasing the credit availability to small and affected businesses. This could be directed in the form of customized revolving loan funds set up with MFIs to provide loans to SMEs helping them get back on track.

- Supporting SMEs – Governments through regulations and MFIs further can ensure the SMEs are supported in all possible manner as they are growth drivers for a large section of the society. SMEs should also be channelled towards identifying and working on appropriate funds in order to back their fragile settings.

The Response

The world calls for an inclusive economic growth with every section of the society addressed so as to not deepen the economic crisis. This only highlights the importance of financial inclusion, that forms the basis of the micro lending industry. Governments must also take the responsibility and support MFIs by allowing the use of digital signatures, accepting biometrics for loan disbursement and approval of credit roll-over remotely. These measures will ensure more and more marginalized people are able to reach out to the micro lending institutions while practicing social distancing. This can be only be achieved through adaption and investment on advanced technologies – deploying micro lending software, built over a high-quality architecture providing instant loans.

The global microfinance industry has addressed the needs of the poor and survived several catastrophes only to rise stronger. This has only been possible through the collective efforts by all the stakeholders - providers, donors, investors, policymakers, academics and other practitioners, to make inclusive financial services available to the world’s poor. This is the time the MFIs can use their strength to mobilize the world population to escape the crisis unhurt.

Read Also

Exploring Microfinance – One Dollar at a time

iMax Empowers West African Operator with Real-time Credit Control & Management