Embedded finance are the financial services provided on the customer's terms, at any time and from any place. They allow the customers to perform banking transaction without having to visit the physical bank branches. In some circumstances, embedded finance can completely replace the traditional bank while encompassing banking and financial services.

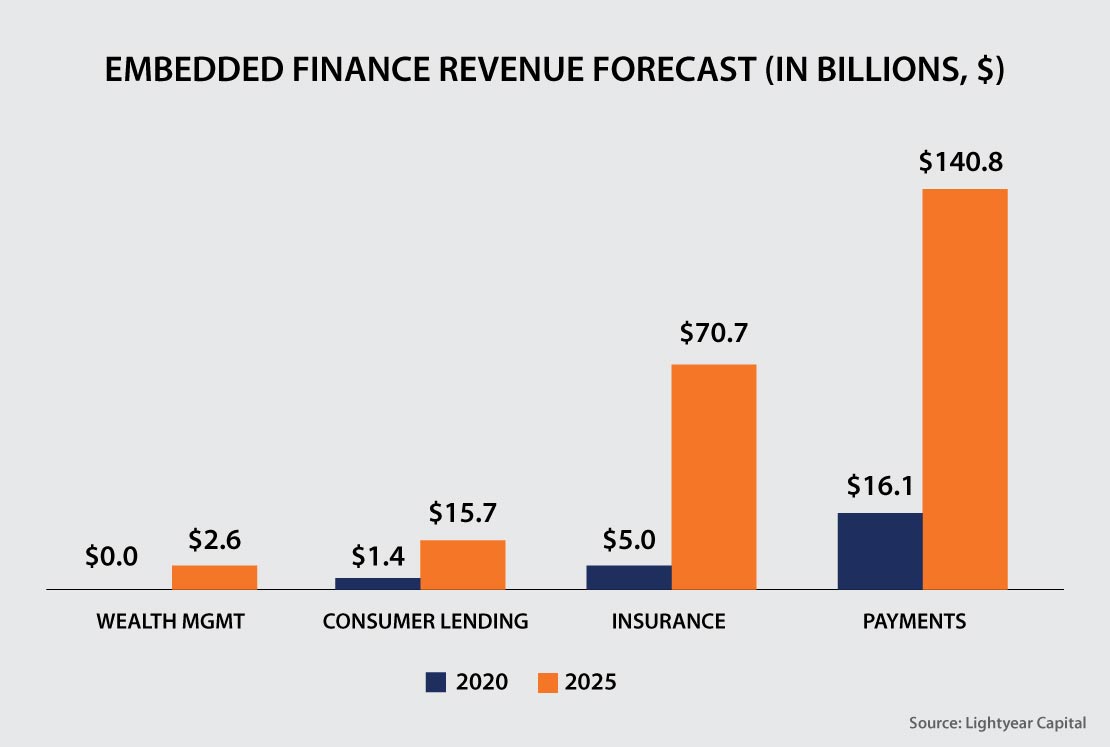

According to a research by Lightyear Capital, revenue gains from the embedded finance will climb up to tenfold from $22.5 billion in 2020 to $230 billion in 2025.

Opportunities in Embedded Finance

Online Payments kicked off the embedded finance trend, allowing consumers to pay for a ride or purchase without having to switch apps. Banking, insurance, consumer lending, and wealth management are now all included in embedded finance.

These developments have made it possible for non-financial companies to provide financial services using APIs. As a result, they won't have to bear the trouble of establishing fintech divisions or redesigning existing systems.

Why Embedded Finance?

Enhanced Payment Process

The lack of control in the client checkout journey is one of the biggest challenges for e-commerce firms. They must ensure that the full procedure takes place in one place rather than diverting customers to external platforms. Integrating payment APIs in an e-commerce platform has two benefits: it improves the payment experience and allows businesses to effectively analyze customers' payment patterns. Additionally, the financial interactions among the players will be well-synchronized, resulting in speedy transaction and settlement operations.

Automate Financial Statements

It is the fundamental obligation of every business to maintain financial books in order. However, this is a complex, time-intensive, and error-prone process which results in contradictory entries, receipt alteration, and other major mistakes. However, companies may automate bookkeeping, improve their operational strategy, deploy funds for strategic initiatives and prevent fraudulent activity by embedding financial APIs.

More Customers Higher Revenue

Embedded finance allows financial organizations to reach out to the most valuable consumers and take advantage of e-commerce platforms' distribution capacities by providing niche payment and credit experiences. Also, the underwriting process and effective credit lifecycle management will result in a considerable rise in revenues and low expenses for customers.

Customized Services

Customers nowadays are always looking for options that are both economical and customizable. Embedded finance enables a range of user-friendly, easy-going, and cost-effective financial services for the customer. Furthermore, by making it a contextual financial solution, they may be further customized to meet the needs of the customers.

Forms of Embedded Finance

While most people think of embedded finance as a payment solution, it can also refer to a variety of other financial services.

Embedded Payments

After the increasing usage and penetration of digital wallets, the trust of the customers towards digital finances has grown significantly. Embedded payments, help the service providers to make that the purchase possible and seamless. All that's required is an embedded payment app and a few clicks to entirely remove the discomfort.

Embedded Credit

The embedding of credit products into non-financial digital channels is referred to as Embedded Credit. This enables users to apply for and obtain loans (as well as repay them) in the context of the site. For example, customers who buy kitchen equipment on an e-commerce platform can pay for it over time with an EMI at the point of sale, without ever leaving the digital platform.

Embedded Insurance

Embedded insurance includes insurance in the purchase of a product or service. Insurance solutions can be integrated with mobile apps, websites, and other partner ecosystems using transactional APIs and technology provided by embedded insurance companies.

Instead of developing the complex functionality internally, platforms prefer to engage with external insurance providers. Insurance businesses, on the other hand, work with out-of-date tech stacks that are difficult to integrate. Embedded Insurance infrastructure companies use their tech stack to make it seamless to connect with insurance providers.

Embedded Investment

Embedded Investment, in its simplest form, enables platforms to include stock market trading within their vertical services. The trend of embedded investment has been spearheaded by API-based brokerage firms. They've designed APIs for almost each and every microservice such as opening account, financing, trading, portfolio management, and market data. It enables a variety of platforms to provide investment services to its customers in context.

Embedded Banking

Though they may seem similar, embedded banking and embedded finance are not the same things. Embedded finance is a broader term that refers to all types of financial services. Embedded banking, on the other hand, has the potential to eliminate or obscure the role of traditional banks. It incorporates banking services into non-financial businesses, such as digital wallets, BNPL programs (Buy Now Pay Later), unified banking services, and so on.

The Embedded Finance Trend and the Future

Embedded finance has a promising future ahead. It has encouraged banks, fintech companies, and businesses to collaborate and innovate over time. It brings a new viewpoint to simplify and alter tedious processes to improve the user experience. Fintech companies will be able to develop strategic alliances while staying competitive in their product offerings.

Panamax offers innovative financial solutions to take advantage of the phenomenal rise of mobile technology. We provide Digital Financial Solutions and Customer Value Management as a part of our Fintech solutions. Financial institutions, merchants, telecom operators, service providers, and others can benefit from our fraud-resistant and scalable systems, which are designed to automate numerous financial and banking operations.

Related Blogs

Fintech in 2021- 6 Key Predictions and Trends to Watch

How Fintech is Changing the Dynamics of International Remittance