After the immense popularity of plastic money across the globe, now Mobile Money is currently riding the popularity wave. According to a report by MEF that spanned 15,000 mobile users across 15 countries, 69% mobile media users use their devices for banking, while 66% are involved in some form of transactions via their mobile devices.

Demographics suggest that in the US and the UK mobile money has already become a popular mode of making payments; whereas PAN Asia and Africa, mobile money is now fast catching pace and is accelerating the inclusion of unbanked people into the financial ecosystem

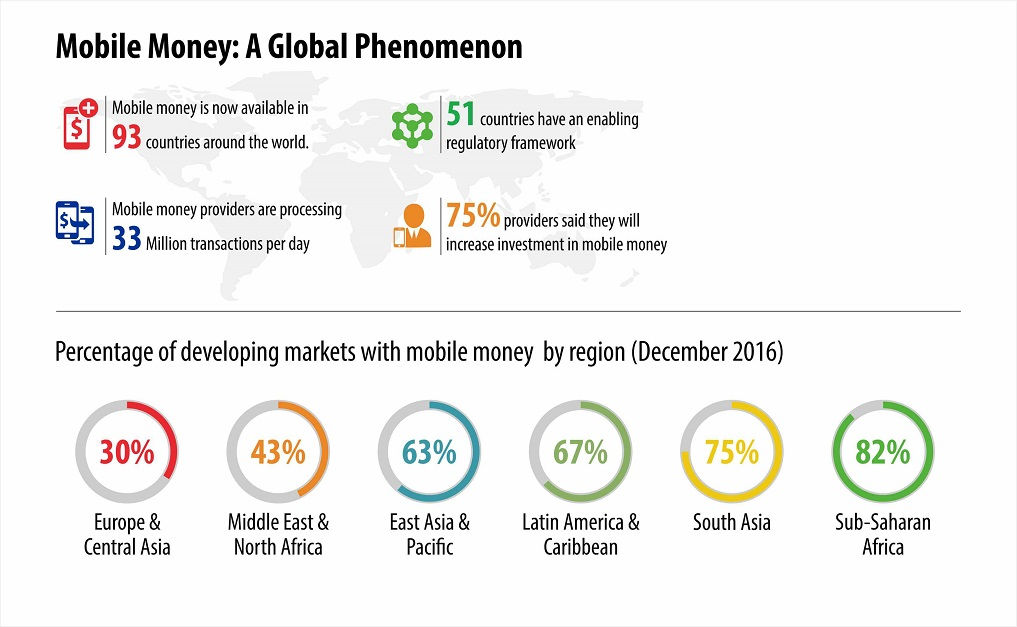

As per another industry report by GSMA, Mobile Money has penetrated 93 countries around the world and is regulated by a robust enabling framework in 51 countries. Service providers are increasingly investing in mobile money. In 2015, revenues grew by 40.3% (CAGR), and 75% providers said they would increase their investment in mobile money. The trend continues and is predicted to grow in the next few years.

(Source: GSMA 2015 state of the Industry report – Mobile money)

In UK, US, Middle East and other developed regions, mobile money has penetrated the daily transactions, whether you are buying a movie ticket, bus ticket, fuel, grocery or fashion - it’s easily done using mobile wallets. There seems to now be a situation where these regions are competing to become the first cashless continent. This phenomenon is also widely spreading across the Asian, and African regions.

However, in several remote areas of Asia and Africa; banks, ATMs, credit card terminals or even landline connectivity is a rarity. In such regions, majority population is unbanked, smartphone penetration is low and internet accessibility is limited. In such scenario, providers should engage more people by allowing them to use Mobile wallets to make payments and all other transactions via regular mobile devices using unique ID codes over POS systems or via USSD. An agent-based model is also a great way to enable mobile money transactions via a third party, for people with limited access to smartphones, internet, etc. This is a huge step in involving the unbanked into the financial ecosystem and transforming the landscapes.

MobiFin Catalyses Financial Inclusion In Gambia

Panamax’s MobiFin is one of the leading players in the mobile money sector. MobiFin technology caters to both emerged and emerging markets enabling people in the most developed areas to the most remotest areas to make payments, book tickets, transfer money, etc. using mobile wallets. In a recently concluded project, MobiFin powered a versatile mobile wallet launched in Gambia, thus encouraging the financial inclusion of unbanked people in Gambia into the financial ecosystem. Download case study here: “Catalysing Financial Inclusion in Gambia”

Future of Mobile Payments in Developed Asia

The Asian continent is extremely diverse hence, while there are remote and underdeveloped regions; there are also developed regions acrossAsia, where smartphone and internet penetration, preference for cashless payment and e-commerce is growing extensively. The mobile money market here is evolving like never before. This region is ready to join the contactless bandwagon using technology enhancements in NFC, EMV, and HCE and overcome the challenges regarding the security & privacy of user data for cashless payment. Technological innovation and increasing focus on interoperability will put these challenges to rest and stoke the wave of cashless payments across the Asian continent.