Challenger Banks or the Payment Service Banks (PSBs) have erupted as an efficient alternate banking solution across the world due to their ease of convenience. When we focus particularly on the more economically backward countries, we will notice the fulcrum PSBs have provided in order to make financial inclusion a reality. According to Global Findex Database, 1.7 billion people across the world are unbanked as on 2018. Two-thirds of these people own a mobile phone that is the key to the expansive digital financial world. These figures are the reason big enough for the digital financial solutions providers to bring this massive volume of population into the mainstream financial system.

Payment banks can bring reform by involving themselves in government aids, pensions, and social benefits to over 95 million in developing economies. Let’s learn more about payment service banks, how they are giving stiff competition to the traditional banking services and promoting microloans for small businesses.

What is a Payment Service Bank?

A payment bank is a differentiated bank with the specific objective of catering to the unbanked and underbanked. Payment banks aim to serve unbanked customers, especially migrant workers and those from lower income households, as well as bring them into the formal financial system. Opening an account with a payments bank is fairly simple and paperless as compared to a traditional bank account opening that needs substantial documentation usually difficult to achieve for the unbanked population.

Who can apply to be a Payment Service Bank?

Banking agents, telecommunications companies, retail chains, Mobile Money Operators (MMOs), courier companies, and fintech solution providers are eligible to apply for a Payment Bank. However, a few businesses like switching companies cannot apply for the license due to the conflict of interest.

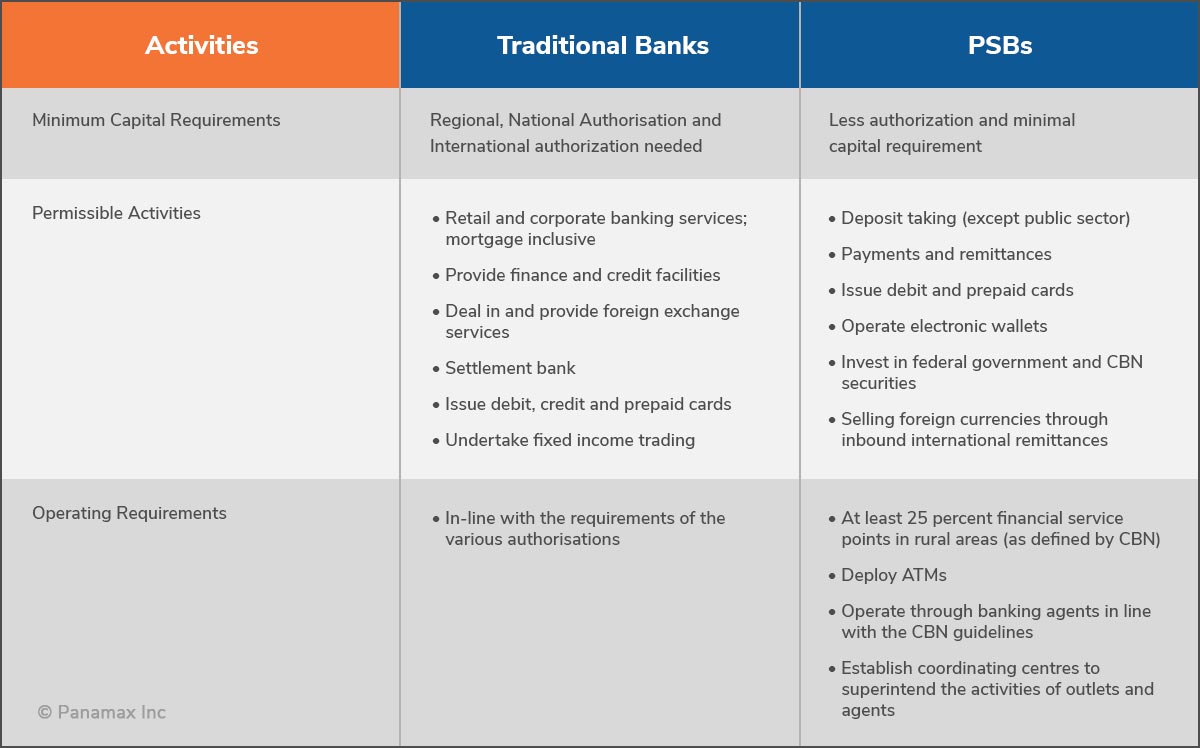

Comparing Traditional Banks and PSBs

Why choose Payment Service Banks?

- Security: With a restricted credit limit, the risk associated with the payment service banks is lower than the regular bank. Further, the PSB deposits invest in government instruments and reduce market risk.

- Ease of use: With simple operations and accessibility through a mobile phone, PSBs have immense reach in every sector of the society. It also helps induce financial literacy among people.

- Minimal operational cost: PSBs depend on technology and build up on the existing brand. This limits their infrastructural capital requirements to minimum and make them suitable for unserved and underserved geographies.

- Simplified KYC: Due to the SIM-Reg database, PSBs usually accept all the mobile phone users ascustomers which saves on-boarding cost for the banks/enterprises and makes it easy for both customers as well as the banks

- Cash takes a backseat: With PSBs supporting small value transactions, currency circulation has reduced across countries making the cashless initiatives successful.

The Way Ahead for PSBs

The future looks promising for PSBs with several countries looking to expand their financial boundaries by including all the sectors of society in the financial ecosystem. In order to be relevant, payment banks should focus on offering use cases that are useful specifically for the unbanked population, primarily, the microfinance software solution. The second target segment is the rural area that can be reared through tie-ups with Microfinance Institutions or MFIs. Farmers and suppliers can directly connect to sell their harvest and make the most of their efforts. Women are another target segment for the payment banks who can be inducted with financial knowledge and manage their finances independently. PSBs with a mix of traditional and trusted banking along with modern digital wallet and payments are the need of the hour with use cases focused on the target segments.