MFS’ bastion of disruption has been built on two key principles of “Moving currency electronic” and “multi-channel”. MFS, in essence, is a “middleman” that doesn’t own anything – it simply facilitates convenient access to fundamental monetary services and range of Value added services through its multi-channel APIs with core peripheral systems viz. CBS, Remittance hub, merchant systems, IN platform and so on. hub, merchant systems, IN platform and so on.

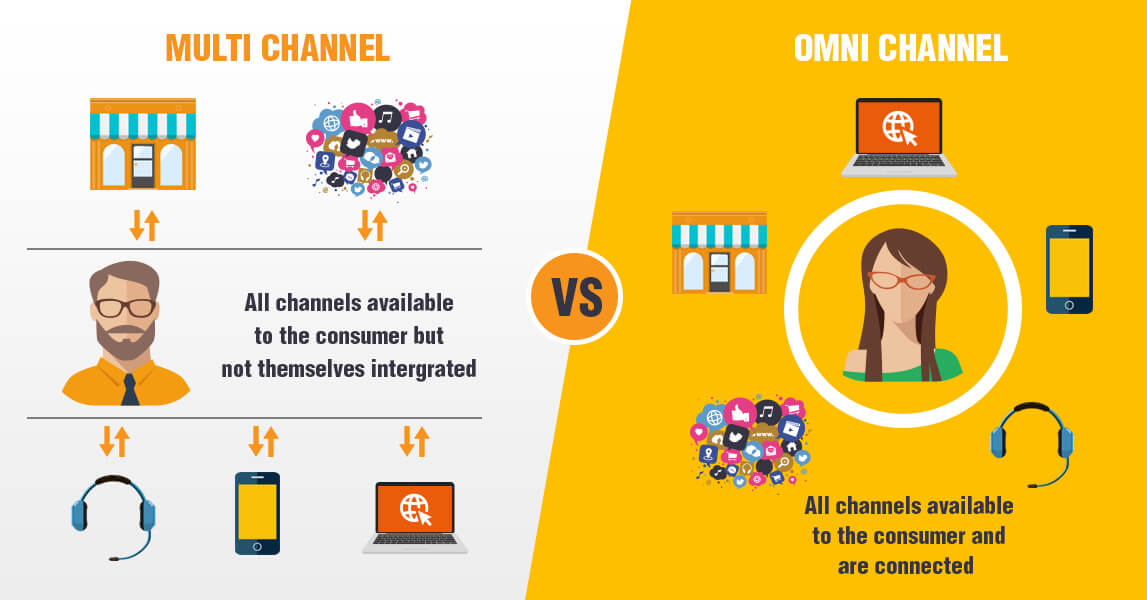

The particular core strength of multi-channel however, is also MFS’ Achilles heel. Each channel has its own backend admin interface to the business owner. Each of these admin panels are silo-centric and there is no consistency of information across them. Thus, the so called business intelligence of a multi-channel system is also confined to the individual channel. As has happened to many middleware IT systems earlier, multi-channel is about to get cut out by two bootstrapped challengers backed by the inherent demand of the telecom, enterprise and financial industry alike.

Called as Omnichannel and Unified commerce, these might be MFS’ best shot to improvise on core abilities and to get the house in order.

Where Omni channel commerce is a consumer-facing proposition, Unified commerce is a provider-to-merchant proposition. The former is about enabling customers to do business on whatever mix of channels they choose. How channels are integrated is as important as what channels are available. Omnichannel smartly capitalizes on the failure of multi-channel to produce an integrated view of the business.

Unified commerce, on the other hand, is the ability for the financial service providers to source a full suite of POS and mobile commerce capabilities, business management solutions, and advanced managed services, all from a single point of contact. It calls for one vendor that can package the services in a single bundle in order to make implementation and management simpler — and more profitable — for any service provider. The crux is the ability of the entire MFS ecosystem of a service provider to be more easily integrated and overseen by a sole, qualified and accountable business partner.

In this article, my two cents would be on the former.Omnichannel is an outcome of two combating forces in the MFS space viz. rapid digital channel growth and strong factors that still attract consumers to branches.

Factors that drive digital banking are

- Cost savings – Relatively less cost to go digital than to maintain and open new branches

- Customer adoption – Educated customers, vying for convenience.

- Customer satisfaction – Long service queues in branches leading to customer migration

Factors that help sustain branched banking are

- Customer trust – More trust in local staff than the trust in brand

- Service preferences – Human tendency to get assistance while doing certain transactions

- Branch role in sales – Convenience of branch location leads to customer switching

This certainly shows that the foretold story of “death of branches” is slightly dubious. Even technophiles are dual citizens of the physical world. Brick and mortar continues to be a key element of a bank’s operations and thus the Omnichannel experience should rather allow the customers to choose the most appropriate channel(s) for any given interaction, enable a seamless customer transition from one channel to another (ability to pick from the state where it was left at the previous channel), correspondingly giving bank a 360 degrees view of the journey across all the hops.

With the pace at which technology advances, it is hard to state whether Omnichannel would be the next Unicorn for the service industry, but its aforementioned embalming abilities for the businesses, indeed make it here to stay.

Concluding here with the diagrammatic depiction of a customer’s journey in an Omnichannel environment.