Experience the magic of a sophisticated platform with Kafka-based messaging bus architecture

Futuristic platform with all interactions using APIs making it easy to integrate with new digital solutions and third-party services.

Your customers can enjoy seamless experience across all digital channels giving them ease of use and convenience

Constantly evolving strategies? No problem, as you can integrate use cases at any stage of the project development

Use your business capital wisely without having to spend on bulky hardware equipment and zero security concerns

API-first approach with open API framework

True microservices design enabling horizontal and vertical scalability

Central resource management and monitoring with intuitive dashboards

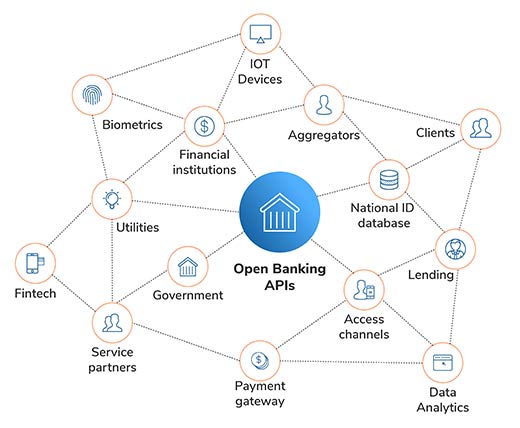

Open Banking APIs

GUI-based integration and API management module offering flexibility and ease for API integrations for an enriching customer experience and improved revenue for the facilitators

Platform Access Channel & Device Authentication

Define and configure authentication and authorization policies for different access channels like Mobile App, Web Portal, USSD, SMS, etc.

Notifications and Alerts with AML Rule Engine

Configurable and reusable notification templates for different events through different channels like SMS, email, app notifications, social media

Redundancy and Multitenancy

Provides High Availability with Disaster Recovery and Multitenancy with optimal usage of hardware and software, eliminating issues with traditional software licensing and upgrade model

Reports and Dashboards

Detailed dashboards and reports available across multiple access channels for real-time analytics

Powerful Integrations

Legacy or modern, MobiFin powerful platform can be integrated with any third-party solution to offer biometrics, virtual cards, tokenization, and other services

Easy Customization and Configuration

MobiFin offers extensive set of functionalities which are in line with on-going trends in the market ensuring flexibility to choose as per the business need

Multi-step Approval and Profiling/Segmentation

Offer separate profiles for customers and channel partners to provide different access rights to different users

Deployment Flexibility

No restriction/limitation in deployment of solution

eKYC and Digital Onboarding

Seamless onboarding of different user entities by collecting KYC details digitally

Digital Customer Onboarding, and Account Opening

Achieve higher onboarding conversion rates. Grow share-of-wallet with seamless origination. Improve the security, quality and accuracy of document and data capture

Flexible Digital Products Creation

Create tailored digital products to respond to ever-changing customer needs. Use fees, commission splits, limits and other business rules. Sync with any core banking or insurance system

Settlement and Ledger Management

GUI-based dynamic and configurable ledger and settlement management for entities like Customer, Merchant, Agent, and Vendor

Agent/Merchant Management

Ensure the efficient performance of your network operations

Customized Products and Payment Processing

Configure, manage and offer full spectrum of payments in fintech across different domains like Mobile Money, Digital Banking, Loan Products, and Loyalty Programs

Dynamic Reporting Tool

A GUI-based and query-based reporting tool to generate and view different reports with required parameters and filters

Virtual Cards and Tokenization

Contactless, sophisticated and easy to use payment module for new-age transactions

True Microservice Architecture

Strengthening technology with execution units breaking down a service into multiple sub-execution units

Design Canvas

Create a seamless customer experience with a dedicated Backend For Frontend (BFF) interfaces with menu manager and content management system to offer state-of-the-art UI/UX

Mobiview – Spend Less Time Tracking, More Time Growing

Offers real-time transaction and system monitoring powered by ELK stack (with Kibana) which offers instantaneous insights of logs, application status and system statistics

Chatbots and Conversational Banking

AI-powered chatbots to engage the customers and address any grievances in real-time

Comprehensive Wallet Platform with sub-wallets, pockets, and parent-child-sibling wallets. Can be linked to bank accounts, trust accounts, cards, etc.

Comprehensive Payment Platform for merchant payments, peer-to-peer payments, bill payments, tax collection, subsidy disbursement, and ACH

Open banking APIs, core banking interface, and agency banking interface

Flexible commissioning, loyalty/rewards, campaign management, and micro-credit/micro-loan servicing platform